Member Promotions

Current Promotional Offers on Exceptional Products

Checking Promotions

Open a Free Checking Account and Earn a $100 Cash Bonus1

Get a $100 cash1 bonus when you open a new Free Checking account from BMI Federal Credit Union. You'll get a free checking account that's actually free. Open an account online!

- No monthly account fees

- No minimum balance requirement

- Free Visa Debit Card

- Access to the second largest Shared Branching Network with roughly 30,000 ATMs

- Routing and Transit Number: 244077035

Open an Account

Refer a Friend and Earn a $100 Cash Bonus** For Yourself, and a $200 Cash Bonus*** For Your Friend

Earn a $100 cash bonus when you refer a friend to join BMI Federal Credit Union. That's a $100 cash bonus for you, and a $200 cash bonus for them! This offer is perfect for existing BMI Federal Credit Union members. Use the promo code FRIEND26 when you apply online, or print your Refer a Friend card and bring it to any branch.

|

Loan Promotions

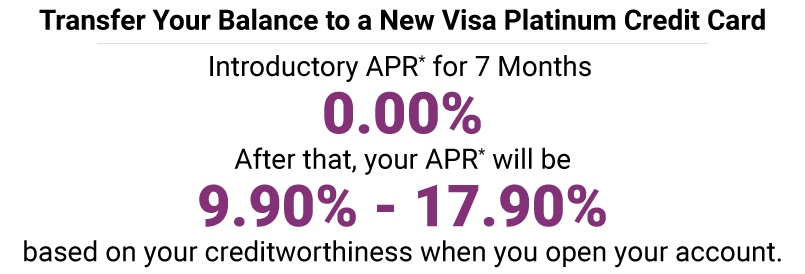

Why Pay Higher Rates? Our Credit Card Offerings Have Lower Rates Than the National Average!

We also have a great balance transfer promotion on our Visa with Rewards credit card!

Great Benefits On Both BMI FCU Visa Credit Cards

|

*Application and Solicitation Disclosure

Interest Rates and Interest Changes

|

| Annual Percentage Rate (APR) For Purchases |

VISA Platinum and VISA Platinum Secured:

9.900% to 17.900%, based on your creditworthiness.

VISA With Rewards and VISA With Rewards Secured:

16.740% to 18.000%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate. |

| APR For Balance Transfers |

VISA Platinum and VISA Platinum Secured

For Transactions Below $1,000.00

9.900% to 17.900%, based on your credit worthiness

For Transactions $1,000.00 and Greater

0.00% Introductory APR for seven months from the first balance transfer.

After that, your APR will be 9.900% to 17.900%, based on your creditworthiness.

Visa With Rewards and Visa With Rewards Secured

For Transactions Below $1,000.00

16.740% to 18.000% based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

For Transactions $1,000.00 and Greater

0.00% Introductory APR for seven months from the first balance transfer.

After that, your APR will 16.740% to 18.000%, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

|

| APR For Cash Advances |

VISA Platinum and VISA Platinum Secured

9.900% to 17.900%, based on your creditworthiness.

VISA With Rewards and VISA With Rewards Secured

16.740% to 18.000% when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

|

| How to Avoid Paying Interest on Purchases |

Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month. |

| For Credit Card Tips from the Consumer Financial Protection Bureau |

To learn more about factors to consider when applying for or using a Credit Card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore. |

Annual Fee

- Annual Fee - Visa Platinum and Visa Platinum Secure

- Annual Fee - Visa with Rewards and Visa with Rewards Secured

|

None

$49.00 |

Transaction Fees

- Foreign Transaction |

1.00% of each transaction in U.S. dollars |

Penalty Fees

- Late Payment

- Returned Payment

|

Up to $25.00

Up to $25.00 |

How We Will Calculate Your Balance: We use a method called "average daily balance (including new purchases)."

Promotional Period for Introductory APR - Visa Platinum and Visa Platinum Secured:

The introductory APR for balance transfers will apply to transactions of $1,000.00 or greater posted to your account during the first 30 days following the opening of your account. Any existing balances on BMI Federal Credit Union loan or credit card accounts are not eligible for the Introductory APR for balance transfers.

Effective Date:

The information about the costs of the card described in this application is accurate as of: December 11, 2025. This information may have changed after that date. To find out what may have changed, contact the Credit Union.

For California Borrowers, the Visa Platinum and Visa Platinum Secured and Visa With Rewards and Visa With Rewards Secured are secured credit cards. Credit extended under this credit card account is secured by various personal property and money including, but not limited to: (a) any goods you purchase with this account, (b) any shares you specifically pledge as collateral for this account on a separate Pledge of Shares, (c) all shares you have in any individual or join account with the Credit Union excluding shares in an Individual Retirement Account or in any other account that would lose special tax treatment under state or federal law, and (d) collateral securing other loans you have with the Credit Union excluding dwellings.

Notice to New York Residents:

New York residents may contact the New York State Department of Financial Services to obtain a comparative listing of credit card rates, fees, and grace periods. The New York State Department of Financial Services may be contacted at

1-800-342-3736 or www.dfs.ny.gov.

Other Fees & Disclosures:

Late Payment Fee:

$25.00 of the amount of the required minimum payment, whichever is less, if you are 15 or more days late in making a payment.

Annual Fee -Visa with Rewards and Visa with Rewards Secured:

$49.00.

Returned Payment Fee:

$25.00 or the amount of the required minimum payment, whichever is less.

©TruStage Compliance Solutions 2009, 10, 12, 16, 2023

03400649-MXC10-C-4-071923 (MXC104-E)

1Enter promo code ADD26 when applying online or mention when applying in person. Cash bonus of $100 will be deposited in the member's savings account within 10 business days after all qualifications have been met. The following requirements must be met in the first 90 days after the account is opened: 1) Open and deposit $20.00 into a new free checking account. 2) Make a minimum of 30 Visa debit card transactions of at least $5 each in the first 90 days. 3) Sign up for electronic statements. Cash bonus may be considered income and reported on 1099-MISC or 1099-INT. Offer not valid on Starting Over Checking, Platinum checking, or Business accounts. This offer is not available to those with fiduciary accounts, those who have closed an account within 60 months, or have a negative balance. Checking account must remain open for a minimum of 12 months or the bonus will be debited from the account at closing. Offer cannot be combined with other checking offers or add-on bonus offers. Membership eligibility and account requirements apply. BMI FCU is open to everyone who lives, works, worships, or attends school in Franklin, Licking, Fairfield, Pickaway, Madison, Union, Delaware, or Morrow County. Federally Insured by NCUA. BMI FCU may amend, suspend, or discontinue this offer at any time without notice. Offer ends March 31, 2026.

Refer A Friend Program - **Existing Member: New member must mention name of referring member when account is opened. Cash bonus of $100 will be deposited to referring member's savings account within 10 business days after the New Member Offer is qualified. Limit of five (5) referrals per member. Cash bonus may be considered income and reported on 1099-MISC or 1099-INT. ***New Member: Enter promo code FRIEND26 and existing member's name when applying online or present this card when opening account in person. Cash bonus of $200 will be deposited in the new member's savings account within 10 business days after all qualifications have been met. The following requirements must be met in the first 90 days after the account is opened: 1) Open and deposit $20.00 into a new checking account. 2) Make a minimum of 30 Visa debit card transactions of at least $5 each in the first 90 days. 3) Sign up for electronic statements. Cash bonus may be considered income and reported on 1099-MISC or 1099-INT. Offer not valid on Business accounts. This offer is not available to those with fiduciary accounts, those who have closed an account within 60 months, or have a negative balance. Checking account must remain open for a minimum of 12 months or the bonus will be debited from the account at closing. Offer cannot be combined with other checking or add-on bonus offers. Membership eligibility and account requirements apply. BMI FCU is open to everyone who lives, works, worships, or attends school in Franklin, Licking, Fairfield, Pickaway, Madison, Union, Delaware, or Morrow County. Federally Insured by NCUA. BMI FCU may amend, suspend, or discontinue this offer at any time without notice. Offer ends March 31, 2026.

+Visa's Zero Liability Policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use. Contact your Issuer for more detail.